Of Balls and Bulbs…

Abstract for my paper which I presented at the Libertarian Scholars Conference, 2019:

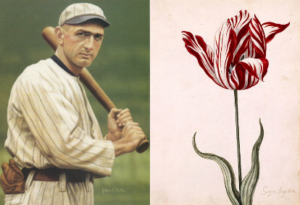

“Fast Balls and Fast Bulbs: The Cause of Reckless Yet Rational Gambling Speculation on American Baseball 1917-1919 and Dutch Tulips 1636-1637”

Mr. Athanasius (Gary) Richied

Focus: A historical and economic analysis of the marked similarities extant between rampant wagering on baseball and the tulip mania phenomenon.

Author Credentials: Adjunct Professor of History–Loyola University-Chicago

Professor of American and European History–Fenwick High School

M.A. Social Science–University of Chicago

M.A.T. Aquinas Institute of Theology

B.A. History and French–Loyola University-Chicago

Abstract

“Black Betsy”, “Semper Augustus”, and “Viceroy”: All three won for gamblers–and even some desperate amateur speculators with good fortune–inordinate sums of money. The star-crossed lost more than guilders and dollars. They surrendered land and livelihood in the saddest of cases. Many emerged with reputations and family names muddied. Two different times; two different places. Baseball wagerers bet for and against Shoeless Joe Jackson’s bat in 1919 especially. Dutch and greater European speculators went all in on tulip bulbs with fancy names, 1636-1637. To my knowledge, never before have the Black Sox Scandal of a century ago and tulipmania four centuries plus ago been compared and yet, upon some considerable research, this absence indicates a lack of creative history and a true lacuna in scholarship. To be sure, much ink has been spilled chronicling the two phenomena, however historians especially but economists as well have failed to provide both profound and convincing analyses of the causes of the seemingly wild yet in the end altogether rational speculation in both cases. This paper fills that hole. I argue in it that regarding both scenarios, it is only through the lens–historical and economic–of the Austrian school that baseball and tulip bulb gambling can be properly explained. Government prompted price inflation led individuals and investor cadres–not to what Keynesians might chalk up to irrational, animal spirits–but rather to rational, marginal utility election to beat inflationary pressures, to evade high tax burdens, and simultaneously maintain relatively high standards of living.

Thus, were the Arnold Rothsteins and Dutch koopman of the world so different? More so, were the grunts in Fenway Park’s Gamblers’ Row that different from the ordinary Dutch laborer, both looking at the tumbling value of the currency in their hands and both willing to gamble to “hit it big”? Absolutely not. They were kindred spirits and only the praxeological hermeneutic Mises, Rothbard, and Murphy can help us to appreciate their true similarities.